Taiwan Patent Annuity Payment Procedures Q&A

We offer Taiwan Patent Annuity Renewal Services specifically designed for foreign patent owners. In addition to the patent fees paid to the Taiwan IPO, Evershine’s service fee per patent is priced below US$30 (excluding VAT), with the exact amount depending on the number of patents being engaged.

It’s worth noting that Taiwan Evershine Patent Attorney Firm is an esteemed member of the Evershine group, which comprises over 20 affiliated enterprises.

Taiwan Patent Annuity Renewal Services for foreign patent owners

Contact us:

Email:patent.tw4ww@evershinecpa.com

Or

Evershine CPAs Firm/Evershine Patent Attorney Firm

Evershine Affiliate linkedin

6F, NO.378,Chang-Chun Road, Chung-San District, Taipei

Dale C.C. Chen Principal Partner/CPA in Taiwan+China+UK

Dale Chen Linkedin

WhatsApp:+886-933920199

Wechat ID: evershiinecpa ;

PRS-TW-010

How long does it take to start paying the renewal patent annual fee after a Taiwan patent is granted?

What is the definition of the due date for the annual renewal patent fee?

How many days before the due date can I start paying?

If the payment is not made after the due date, how long does it take to make the payment and how much is the late payment fee?

How long does it take for the patent to expire?

Taiwan Patent Renewal Fee Regulations webpage?

Answer:

The annual fee for the invention patent shall be calculated from the issued date , and the annual fee for the first year shall be paid when the certificate is obtained; the annual fee after the second year shall be renewed before the “due date”.

Please refer : https://topic.tipo.gov.tw/patents-tw/cp-733-881739-0b170-101.html

The annual fee can be paid for one year at a time or several years at a time.

Patents can be renewed up to 6 months before the due date.

The annual fee can still be legally paid within 6 months after the due date, but there is a surcharge fee of 20%-100%.

If the payment is not made within 6 months after the due date, the patent will be expired.

Please refer : https://law.moj.gov.tw/ENG/LawClass/LawAll.aspx?pcode=J0070007

Taiwan Patent ACT

Article 93 Time period for payment of annuity

The annuity for an invention patent shall be paid starting from the publication date. Payment of the

first-year annuity shall be made pursuant to the provision set forth in Paragraph 1, Article 52 hereof,

while the payment of the second-year annuity and the annuities thereafter shall be made before the

period thereof expires.

The annuity for several years may be paid at one time. Under such circumstance, if the annuity rate

is adjusted upward, the patentee concerned will not be required to pay the deficit.

Article 94 Addition of annuity

If the annuity for the second or any subsequent year is not paid within the specified time period, a

late payment can be made within six (6) months after the original due date with a specified

percentage addition.

The additional annuities based on the specified percentage addition as stated in the preceding

paragraph means that the additional annuity shall be paid depending on the amount of time

elapsed from the original due date. For every month that has elapsed, an additional fee at a ratio of

20% shall be paid; the maximum of the additional fee shall be the same as the amount originally

due.

The elapsed time from one day to one month shall be deemed as one month.

Article 95 Reduction of annuity

Where the patentee of an invention patent is a natural person, school or small and medium

enterprise, the patentee may request for a reduction of patent annuity with the Specific Patent

Agency.

Conclusion:

https://patent.evershinecpa.com/patent-renewal-fees

PRS-TW-020

In addition to paying the patent annual fee in the Taiwan by the patentee, if you want to pat the annual fee, do you have to go through a patent agent?

Answer:

No, anyone can pay without a patent attorney.

PRS-TW-030

Usually, countries around the world pay the patent annual fee online and by mail.

Online can be pay by credit card or debit card or pre-deposit account, and mail can be accompanied by check or postal money order or money order. How many ways are there to pay the patent annual fee in Taiwan?

Answer:

There are 7 ways to pay the patent annual fee in Taiwan: 1. Cash, 2. Bills, 3. Postal transfer, 4. Automatic deduction by agreed account, 5. Online payment, 6. Virtual account payment, 7. Mobile payment etc.

Please refer: https://topic.tipo.gov.tw/patents-tw/cp-733-881739-0b170-101.html

- Cash: Please prepare the patent annual fee payment application form and pay it to the offices in Taipei, Hsinchu, Taichung, Tainan, and Kaohsiung. Mail is not allowed.

- Bills: limited to demand bills (checks, drafts, banker’s checks, and demand bills means that the date on the bills should not be later than the date they were sent to the Bureau; non-demand bills will be returned by the Bureau directly.), Beneficiary: is “Intellectual Property Bureau of the Ministry of Economic Affairs”, and please indicate “endorsement transfer prohibited”. Please attach the receipt to the payment application form by registered mail or pay in person at the receipt counters of this bureau.

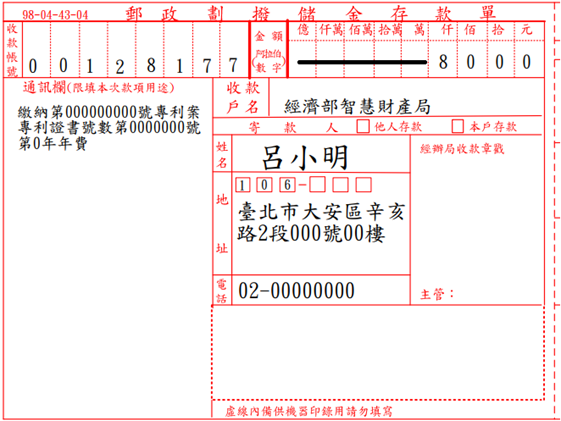

- Postal transfer: The transfer account number is 00128177, and the account name is “Intellectual Property Bureau of the Ministry of Economic Affairs”. Please add the application number, patent certificate number and payment year in the communication column of the transfer slip.

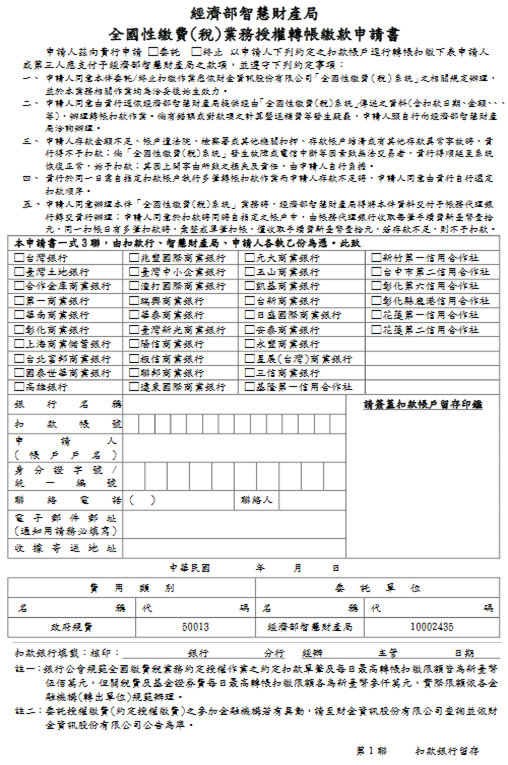

4. Automatic withholding of the agreed account: Please use the deposit account in the financial institution to fill in the “Application for National Fee Payment (Tax) Business Authorized Transfer Payment” (download the National Fee (Tax) Business Authorized Transfer Payment Application Form) ), send (send) this bureau to the bank where the account is opened for verification procedures, and only after this bureau has confirmed the completion, can the agreed withholding function be used (if the patentee is a small and medium-sized enterprise and is eligible for income reduction, an application for reduction of the annual fee must be made by a separate letter in writing. debit).

5.Online payment: Applicants or agents can log in as members at e-Netcom (https://tiponet.tipo.gov.tw), and then click the “Payment” => “Online Payment of Patent Annual Fees” function, You can inquire and check the cases where the patent annual fee should be paid, and you can pay the patent annual fee without submitting a paper application. For related matters, please contact the customer service hotline (02) 8176-9009.

6. Virtual account payment: Please use the payment account on the payment note in the annual fee payment notice (limited to the amount payable on the payment note within the original payment period, not applicable when the additional payment is overdue) ), go to the branches of the cooperative treasury banks in the province or the receipt counters of the bureau to pay at the counter, use the automatic teller machine ATM, online ATM, online bank transfer payment, fill in the remittance slips at the counters of the financial institutions in the province for inter-bank remittance. If the payment is made on the last day of the deadline, due to limited bank business hours, the payment cannot be made in this way after 3:30 pm on that day.

7.Mobile payment: You must first download the “Taiwan Pay” mobile payment APP with your mobile phone or tablet, and bind the financial card, then scan the QR Code in the annual fee payment notice and link it to “Taiwan Pay” for payment (Only within the original payment period, the payment shall be made according to the amount to be paid on the payment form, and it is not applicable when additional payment is required after the due date), and an additional bank fee of RMB 10 shall be paid for each payment.

PRS-TW-040

Can you give a detailed introduction to the steps for online payment of Renew Online Taiwan patent annual fee?

How many payment methods are there for online matching?

Answer:

Step 1: Get a payment notice

TIPO will send the “Patent Annual Fee Payment Notice” to the patentee 2.5 months before the due date for patent annual fee payment.

The notices for the payment of patent annual fees are printed in batches by the computer, and cannot be printed in a single batch.

Home→Patent→Enter the Patent Theme Website→Manage Patent→Patent Annual Fee→Patent Annual Fee Trial Calculation), which is convenient for patentee to check the patent annual fee information at any time. If the applicant does not receive the patent annual fee notice, You can check the patent annual fee related information on the website of the Office at any time.

Step 2: Choose payment method

Including 1. Cash, 2. Bills, 3. Postal transfer, 4. Automatic deduction by agreed account, 5. Online payment, 6. Virtual account payment, 7. Mobile payment etc.

Step 3: Choose payment method

Pay the annual fee according to the selected payment method

Step 4: Get the payment receipt

You can get a receipt on the spot for cash TIPO payment on the spot. If you pay in other ways, TIPO will send a receipt in the future.

PRS-TW-050

Does the Intellectual Property Office in Taiwan provide a deposit account mechanism for online payment?

Are there any special qualifications required to open a deposit account?

Answer:

Agreed automatic account deduction:

Please use the deposit account in the financial institution to fill in the “National Fee Payment (Tax) Business Authorized Transfer Payment Application Form” (download the National Fee Payment (Tax) Business Authorized Transfer Payment Application Form), send it to TIPO transfers the account opening bank for verification procedures, and the agreed withholding function can only be used after the completion of the confirmation by TIPO.

| Intellectual Property Bureau, Ministry of Economic Affairs National Payment (Tax) Business Authorized Transfer Payment Application The applicant hereby applies to your bank for □ entrusting □ termination to transfer and debit the amount to be paid by the applicant or a third party to the Intellectual Property Bureau of the Ministry of Economic Affairs from the debit account agreed by the applicant as follows, and abide by the following stipulations: 1. The applicant agrees that this entrustment/termination of the withholding operation shall be handled in accordance with the relevant regulations of the “National Payment (Tax) System” of Caijin Information Co., Ltd., and that it will become effective after all relevant operations of this business are completed. 2. The applicant agrees that the information (including the date, amount, , etc.) of the deduction will be provided by the Intellectual Property Bureau of the Ministry of Economic Affairs and sent through the “National Payment (Tax) System” to handle the transfer and deduction operations. If there is any error or doubt about the calculation of the payment and the refund, the applicant is willing to consult with the Intellectual Property Bureau of the Ministry of Economic Affairs. 3. If the applicant’s deposit amount is insufficient, the account is detained by the court, prosecutor’s office or other authorities, the deposit account is settled or there are other abnormal deposit incidents, the bank may not deduct the money; if the “national payment (tax) system” fails If the transaction cannot be performed due to factors such as interruption of telecommunications, your bank may postpone the deduction until the system returns to normal. 4. If your bank needs to perform multiple transfers and debits from the designated debit account on the same day and the applicant has insufficient funds, the applicant agrees that the bank will choose the debit order by itself. 5. When the applicant agrees to handle this “national payment (tax) system” business, the Intellectual Property Bureau of the Ministry of Economic Affairs may deliver this document to the account agency bank and transfer it to your bank for processing; the applicant agrees to deduct the payment from the designated account at the same time Among them, the account agency bank charges NT$10 for each transaction. If there are multiple debits on the same debit day, they will be consolidated into a single debit, and only NT$10 will be charged. If it is insufficient, no deduction will be made. |

https://tiponet.tipo.gov.tw/S080/images2/DeductAgreement.pdf

PRS-TW-060

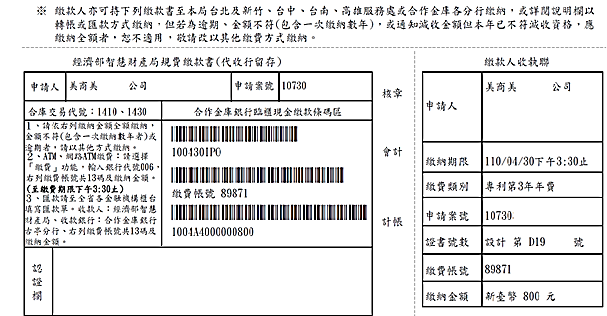

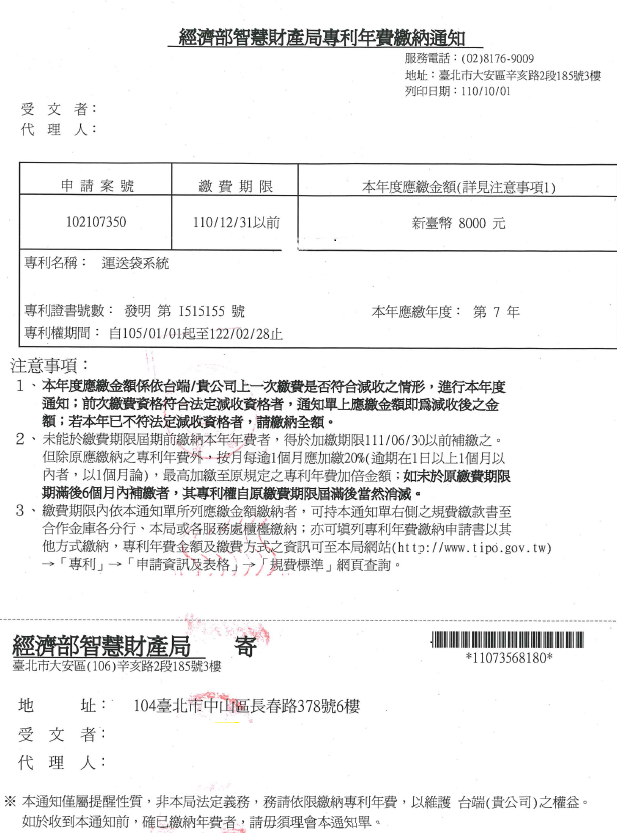

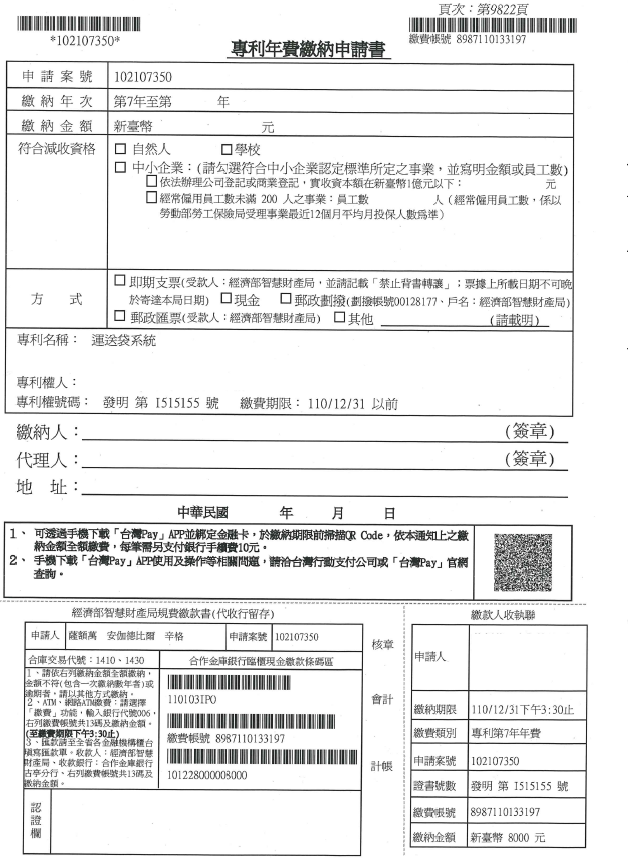

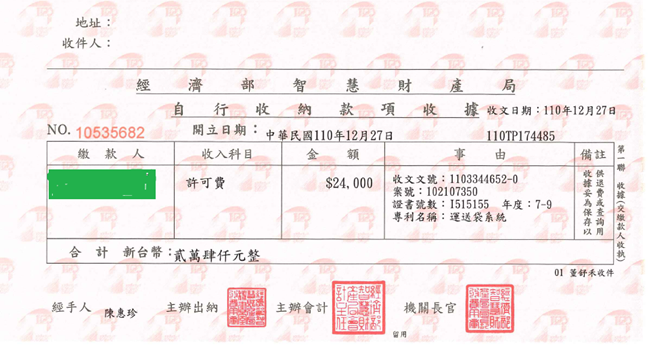

A sample receipt after paying the patent annual fee in Taiwan? What’s in it?

Answer:

Payment receipt:

Country-wise Patent Annuity Payment Procedures Q&A

Contact us :

Email:patent.tw4ww@evershinecpa.com

Or

Evershine CPAs Firm/Evershine Patent Attorney Firm

Evershine Affiliate linkedin

6F, NO.378,Chang-Chun Road, Chung-San District, Taipei

Dale C.C. Chen Principal Partner/CPA in Taiwan+China+UK

Dale Chen Linkedin

WhatsApp:+886-933920199

Wechat ID: evershiinecpa ;

Additional Information

Evershine has 100% affiliates in the following cities:Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo, Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur, Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt, Paris, London, Amsterdam, Milan, Barcelona, Bucharest, Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Phoenix, Michigan, Seattle, Delaware;

Berlin, Stuttgart;Paris; Amsterdam; Prague; Czech Republic; Bucharest;

Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please send email to HQ4tpe@evershinecpa.com

More City and More Services please click Sitemap