Three Services Patterns of Payroll and Attendance

There are three service patterns (code: F, B, S) in Payroll and Attendance Service. These services can be adopted by all kinds of industries and all kinds of scenarios.

F: All use Evershine Salary module and attendance 4 modules: staff scheduling, clocking, leave, overtime.

B: You will use your own scheduling and clocking module in attendance work. We will use Evershine Salary module to serve you. Besides, Batch Cross Check processing will be generated by Evershine and delivered over to your personnel staff.

S: You only use partly modules (complete = 5 modules for salary, scheduling, clocking, leave and overtime), Or although you use of 5 complete modules, but for some reasons, is provided by different vendors of the system, data cannot be integrated. Batch Cross Check processing will be generated by Evershine and delivered over to your personnel staff.

Welcome to contact us:

E-mail: tpe2ww.prl@evershinecpa.com

Or

contact: Kerry Chen, E600

Cell: 886-939-357-000

Three service patterns:

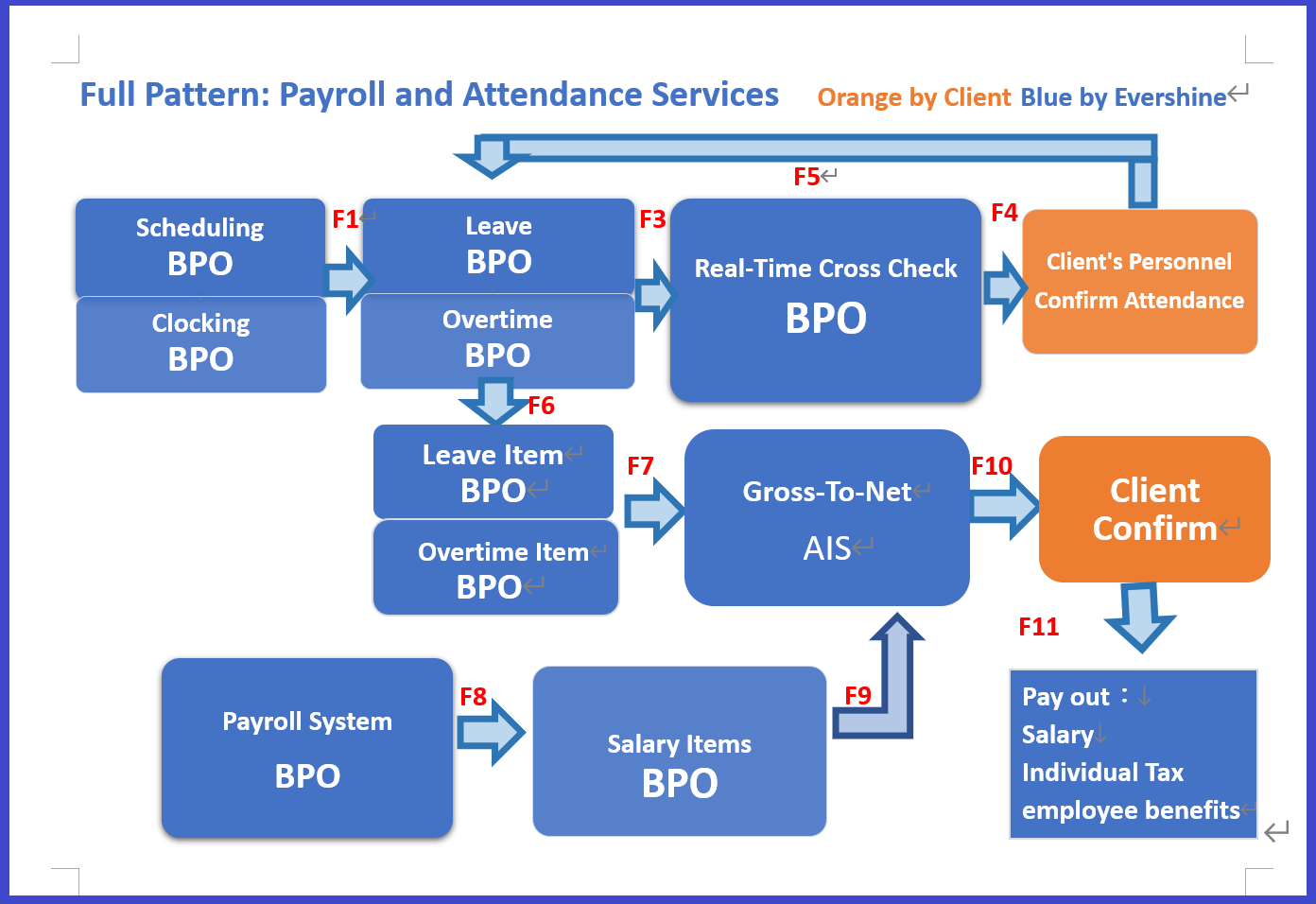

The first type of service pattern( code F =Fully use Ever-shine System):

All use Evershine salary module and 4 attendance modules: scheduling, clocking, leave, overtime.

Use Evershine scheduling module and GPS cell phone clocking module, then transfer to the leave and overtime modules, Evershine’s system outputs a Cross-Checklist like leave without asking-leaving form and un-punched overtime etc. which will be delivered to your personnel staff.

This F service is widely used for white-collar employees.

Evershine Payroll

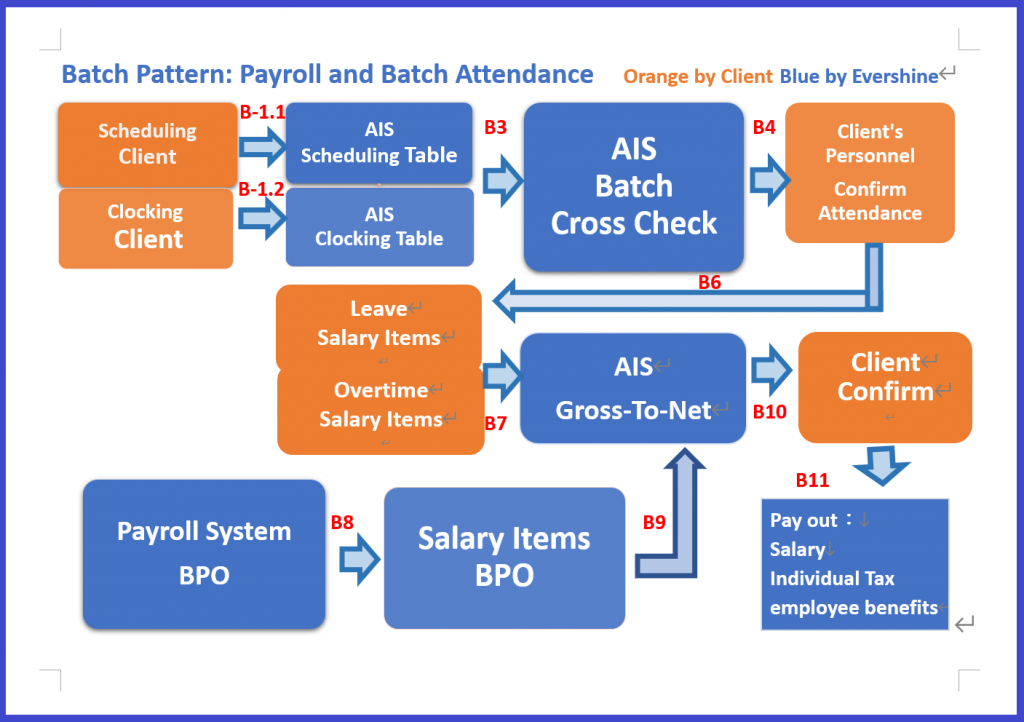

Second service pattern (code B =Batch Cross Check only):

You will use their own scheduling and punch modules.

We will use Evershine Salary module to serve you.

Besides, Batch Cross-Checklist processing will be generated by Evershine and delivered over to your personnel staff.

You send the schedule data and punch data to Evershine every month.

According to your logic, Evershine will produce the Cross-Checklist like leave without asking-leaving form and unpunched overtime etc. which will be delivered to your HR department of the factory and generate correct leave and overtime hours for Evershine payroll and attendance system. This B Service is widely used in factories.

Please refer to the following:

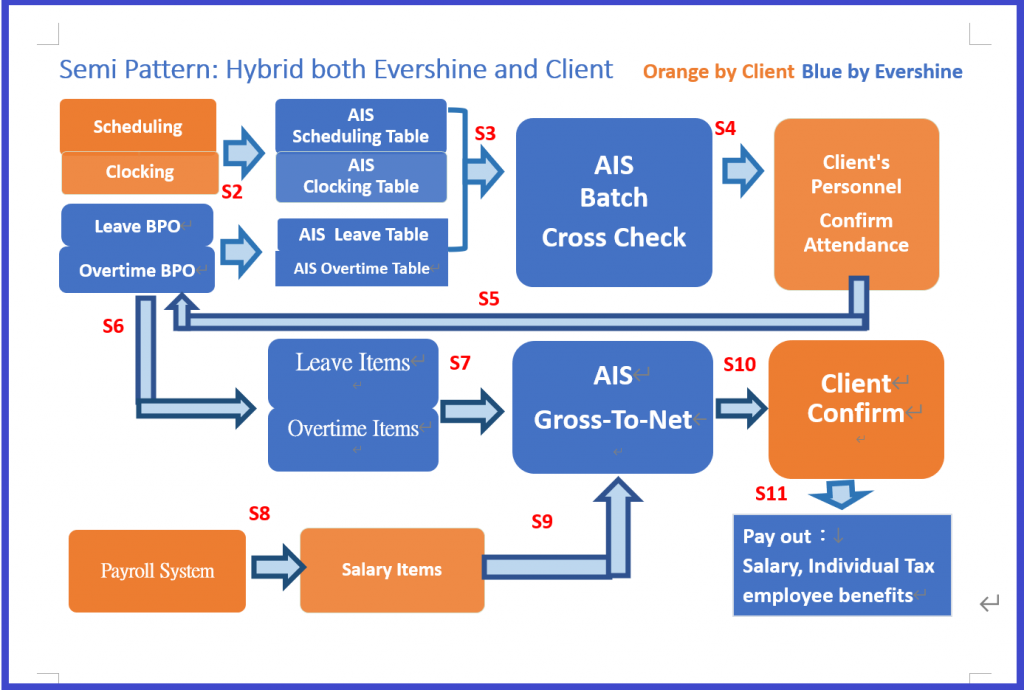

The third service state Pattern (code S = Semi-Automatically):

Your company only uses partly modules (complete = 5 modules for salary, scheduling, clocking, leave and overtime).

Or although the use of 5 complete modules, but for some reason, is provided by different vendors of the system, data cannot be integrated.

Batch Cross-Checklist will be processed by Evershine.

You will send the schedule data, clocking data, leave data and overtime data to Evershine every month.

According to your logic, Evershine produces the Cross-Checklist Report of like leave without asking-leaving form and unpunched overtime etc. which will be delivered to your personnel department, produce correct leave overtime hours to Evershine payroll and attendance system.

Please refer to the following:

A Client asked:

So if we are in the same place and we have a large number of people, we use a face recognition facility, which also be used in the control of access to the factory, while used in staff meal, dormitory, sports equipment, loan management.

In this case, can Evershine provide services without changing our present operation?

Evershine answer:

Surely! You can assign us to provide you Payroll and Attendance Service without changing your present operation.

I guess your company uses a face recognition clocking system, and you should have a scheduling system.

if so, our service should be the above-mentioned second service pattern code B.

However, if you have a leave and overtime system, it will be the third service model S above.

A Client asked:

How do Evershine carry out payroll and attendance processing with your company employees?

Evershine answer:

Supported by Evershine cloud payroll and attendance system , the assigned Service Manager in Evershine Headquarter collaborate with local Evershine colleagues and with your company employees to deliver our services.

Briefly introduce below steps:

Step 1.

Your Parent Payroll System (PPS) can be used by overseas subsidiaries to maintain your overseas staff information and payment information changes.

If your overseas country subsidiary does not use its own system for the time being, you can use Evershine cloud multinational payroll and attendance service platform to maintain your company overseas country staff information and payment information changes.

Step 2.

Your parent company’s payroll system generates the parameters that subsidiaries need to calculate gross pay per employee each time IS-G file (Individual Salary-Gross Salary: IS-G). Can batch in Excel or Text format, FTP, Or exchange at any time through the API.

Step 3.

Evershine cloud transnational payroll service platform integrates your company’s IS-P file and other sources into IS-G File.(Individual Salary-Gross Salary: IS-G).

If necessary, modify and fill in IS-G File data, and regenerate until correct.

Step 4.

Evershine’s overseas national subsidiaries or overseas national partners do the following:

4.A calculates individual tax withholding for each employee

4.B Calculation of statutory insurance deductions and company liabilities for each employee

4.C Calculate the amount of deductions and company liabilities for each employee’s pension

4.D Calculate the net salary balance due to each employee (Individual-Salary-Gross-To-Net: IS-GTN) File

Step 5

Submit the calculated salary profile for each employee to your authorized personnel for review

Step 6.

Generates an upload file to your company’s Internet Bank Format File (( Individual-Salary-Bank-Upload: IS-BU) file To the bank

Step 7.

Release by accounting personnel authorized by your parent company for direct payment to each employee

Step 8.

Evershine overseas national subsidiaries or partners are responsible for payment of individual tax withholding amount to the IRS

Step 9.

Evershine overseas national subsidiaries or partners are responsible for payment of statutory insurance to the Insurance Bureau

Evershine overseas country subsidiaries or partners, responsible for payment of statutory pension withdrawals to the pension administration

Step 10.

Evershine is responsible for these service results, including government filings, Salary statement WS-RU (salary payment details, individual income tax withholding details, statutory insurance deductions details, Statutory pension deduction details), pay bar IS-PS and related journal summons, etc., placed in the cloud multinational payroll service platform, to your authorized personnel inquiry analysis.

If your parent payroll system (PPS) can be handed over to overseas subsidiaries for use, we can transfer the above data file WS-RU and related journal subpoenas to your PPS. Can batch in Excel or Text format, FTP, Or exchange at any time through the API.

Contact Us

If you need Payroll Compliance Service in Taiwan, please contact Kerry Chen:

Manager Ms. Kerry Chen, USA Graduate School Alumni & a well-English speaker

E-mail: tpe4ww.prl@evershinecpa.com

Tel No.: +886-2-27170515 E600

Mobile: +886-939-357-000

Additional Information

Evershine has 100% affiliates in the following cities: Headquarter, Taipei, Xiamen, Beijing, Shanghai, Shenzhen, New York, San Francisco, Houston, Phoenix Tokyo, Seoul, Hanoi, Ho Chi Minh, Bangkok, Singapore, Kuala Lumpur, Manila, Dubai, New Delhi, Mumbai, Dhaka, Jakarta, Frankfurt, Paris, London, Amsterdam, Milan, Barcelona, Bucharest, Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients: Miami, Atlanta, Oklahoma, Michigan, Seattle, Delaware; Berlin, Stuttgart; Prague; Czech Republic; Bangalore; Surabaya; Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period): Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees. Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people. Besides, Evershine is Taiwan local Partner of ADP Streamline ®. (version: 2024/07)

Please contact us by email : HQ4TPE@evershinecpa.com

More Cities and More Services please click Sitemap