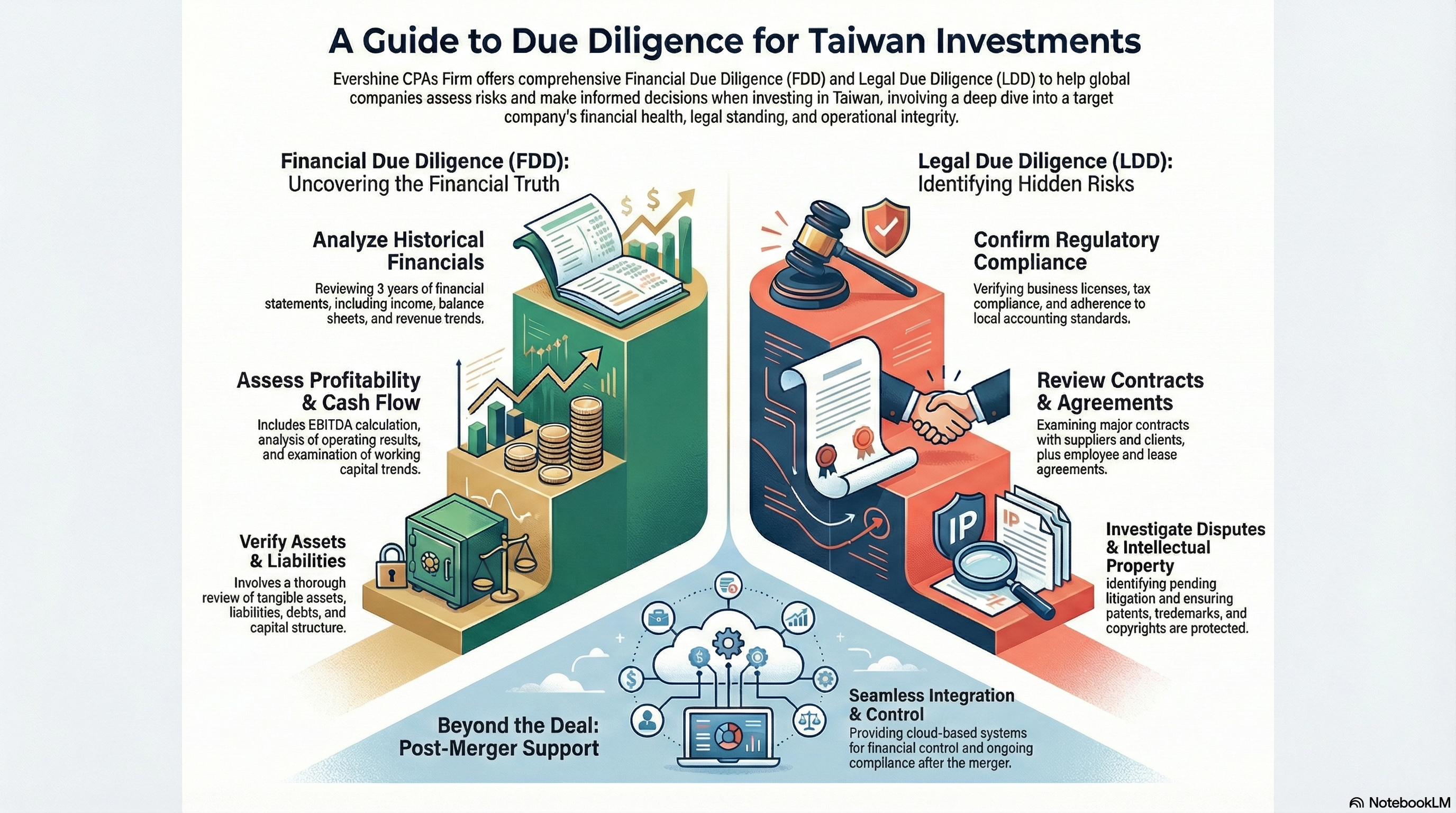

Due Diligence of a Taiwan company

Including both Financial Due Diligence (FDD) and Legal Due Diligence(LDD). Evershine CPAs Firm is well-experienced in doing these services and has already handled a hundred Due Diligence (DD) cases assigned by global companies. Among them, one was a transaction worth 700 million USD.

Email: tpe4ww.dd@evershinecpa.com

Or

Judy Wang Partner, CPA in Taiwan, MBA from Netherlands

Office Tel: +886-2-2717-0515 E100

Mobile: +886-972-235-766

Email:judywang@evershinecpa.com

DD-TW-010

What are Service Coverage of Due Diligence service by Evershine in Taiwan?

Answer:

* Review Past 3 years financial statements

* 5-year financial statement forecast

* EBIDA calculation for your reference

* Tangible Assets Review

* Liability Review

* Share & Loan Capital Structure Review

* Review Intangible Assets

* Tax Risk Evaluation

* Guarantee to bear past tax risk of Target Company, if necessary

* Legal Due Diligence- through contract review to evaluate contingent liability

* Feasible and workable Deal Structure Suggestion

* Review IT and Internal Control System

* After-merger Assistance for better control through cloud collaboration in the IT system

DD-TW-020

What information is typically included in a Due Diligence Report?

Answer:

Every Due Diligence (DD) Project includes specific audit areas.

Upon engagement by clients, our initial task is to review whether the assigned DD scope requires a specialized audit program.

Different DD audit scopes naturally yield different DD reports.

Below, we provide a general outline of DD report for your reference.

1.Company background:

- Company Name:

[Insert Company Name] - Company Registration Number:

[Insert Registration Number] - Type of Business:

[Insert Type of Business] - Date of Establishment:

[Insert Establishment Date] - Shareholders and Ownership Structure:

[Insert Shareholders and Ownership Details]

2.Financial Overview:

- Financial Statements:

Provide the latest financial statements, including balance sheets, income statements, and cash flow statements for the past three years. - Revenue Trends:

Analyze revenue trends, growth rates, and profitability. - Outstanding Liabilities:

Detail any outstanding debts, loans, or financial obligations.

3.Assets and Inventory:

- Asset Valuation:

List and value all company assets, including property, equipment, and investments. - Inventory Assessment:

Describe the company’s inventory and its valuation.

4.Legal and Compliance:

- Business Licenses:

Verify the company’s compliance with relevant business licenses - Pending Litigations:

Identify any ongoing or pending legal disputes. - Intellectual Property:

Ensure that patents, trademarks, and copyrights are registered and protected.

5.Contracts and Agreements:

- Major Contracts:

List and review major contracts, including suppliers, clients, and partnerships. - Employee Contracts:

Review employment contracts and labor compliance.

6.Taxation and Accounting:

- Tax Compliance:

Ensure the company complies with local tax regulations. - Accounting Practices:

Assess the company’s accounting practices and compliance with accounting standards.

7. Operational Due Diligence:

- Production and Supply Chain:

Analyze production processes and supply chain management. - Market Position:

Evaluate the company’s market position, competitors, and growth potential. - Operational Risks:

Identify potential operational risks.

8.Management and Personnel:

- Management Team:

Provide details on the management team, their qualifications, and experience. - Key Employees:

Identify key personnel and their roles. - Organizational Structure:

Describe the company’s organizational structure.

9.Banking and Financial Institutions:

- Banking Relationships:

List banks the company is associated with and assess the health of these relationships. - Outstanding Loans:

Detail any outstanding loans or credit arrangements.

10.Recommendations and Conclusions:

- Summarize the findings of the due diligence process.

- Provide recommendations regarding the potential acquisition, investment, or partnership with the company.

This due diligence report is intended to provide a comprehensive overview of the Taiwan company and its current state.

It should be used as a basis for making informed business decisions.

Please note that further investigation and legal consultation may be required for specific transactions or investments.

DD-TW-030

What are general audit program of FDD (Financial Due Diligence) by Evershine?

Answer:

Each FDD Project will exist some specific audit area.

Basically after being engaged by clients, first job is to review if assigned FDD scope need special audit program.

Here we only list general FDD audit program.

We assume the audit of a targeted company in Taiwan will be 2023, September 30, Then will audit two past years and this year , that means audit financial information for the year ended 31 December 31, 2021 and 2022.

And the financial due diligence service will include three portions as described below:

**Financial Statements and General Information

1.

Obtain monthly income statements and balance sheets for 2021,2022 and YTD 2023.

If required, analyze a schedule of the reconciling items from the total of the monthly financial results to the reported annual financial results.

2.

Inquire about any significant and extraordinary accounting policies or significant changes in accounting policies.

Inquire of Management about the following matters as they relate to the historical periods:

(i) significant and/or unusual accounting policies;

(ii) changes in accounting policies;

(iii) the nature and extent of interim and year-end closing procedures;

(iv) unusual or non-recurring items of income and/or expense;

(v) transactions occurring that represent “soft” income (e.g., reversals of excess reserves); and,

(vi) accounts that involve a significant amount of management judgment, and assess impact of these matters on EBITDA.

3.

Obtain a list of Management’s proposed adjustments to historical EBITDA, obtain appropriate documentation to support each adjustment and assess appropriateness of proposed pro forma adjustments.

4.

Inquire of Management about related party transactions and affiliated party transactions including shared services or allocated costs, if any, and the basis for such shared services and allocations during the historical periods.

5.

Obtain and analyze a schedule of inter-company balances as of and inter-company transactions during the historical periods.

6.

Document a general understanding of and comment on appropriateness of the Company’s financial accounting systems and underlying internal controls and procedures.

**Historical Operating Results

1.

Gain an understanding of and assess the appropriateness of the Company’s revenue recognition policy and other aspects of the Company’s sales policies such as sales terms, billing practices, credit memos, discounts, returns policies, and other allowances.

2.

Obtain and analyze a comparative schedule of monthly revenue and gross margin by appropriate category and product for the historical periods.

3.

Obtain copies of contracts with the ten largest customers and document terms and duration of contracts including pricing terms, renewal terms, commitments, and ability, if any, to cancel orders.

4.

Obtain and analyze a schedule of sales and gross profit by customer/location/region for the historical periods.

Assess revenue and margin fluctuations and document reasons. e.g. new contracts, price changes, etc.

5.

Obtain and analyze the components of cost of sales by category for the historical periods. Identify unusual or non-recurring items affecting reported amounts.

6.

Document and comment on the Company’s practices and methods used to accumulate fixed and variable costs and recognize cost of sales.

7.

Obtain and analyze a comparative schedule of the components of operating expenses for the historical periods.

Identify unusual or non-recurring items affecting reported amounts.

Inquire about monthly variances in the trend of operating expenses.

8.

Prepare a proof of labor by agreeing payroll reports to payroll expense for 2021,2022 and YTD2023.

9.

Obtain and analyze a comparative schedule of other income/expense for the historical periods.

**Historical Balance Sheets

1.

Cash

1.1

Obtain the Company’s bank account reconciliations as of the historical balance sheet dates. Inquire about any unusual items.

2.

Receivables

2.1

Obtain the contract and retention receivable aging reports as of the historical balance sheet dates, identify significant past due amounts, and inquire of management regarding the status and collectability of significant past due amounts.

Consider historical write-off trends, aging and subsequent collections.

2.2

Obtain and comment on the sufficiency of the Company’s computation of the allowance for doubtful accounts (and other accounts receivable allowances) as of the historical balance sheet dates, if any.

3.

Inventory

3.1

Obtain and analyze a schedule of inventory by type as of the historical balance sheet dates and inquire about valuation.

3.2

Obtain and analyze a schedule of excess, slow-moving, or obsolete inventories, if any, as of historical balance sheet dates.

4.

Prepaid and Other Assets

4.1.

Obtain and analyze a summary of the composition of prepaid and other assets at the historical balance sheet dates.

Discuss the nature of and the accounting for these assets and variance from prior years.

5.

Property and Equipment

5.1

Obtain and analyze a list of property and equipment including accumulated depreciation and document the capitalization and depreciation policies.

5.2

Obtain and analyze a roll-forward of property and equipment, including additions, disposals, retirements and/or abandonment during the historical periods.

6.

Accounts Payable and Accrued Expenses

6.1

Inquire of Management as to accounts payable terms (e.g., payment terms, use of deposits or letters of credit), payment practices (e.g., extending terms or taking discounts), and cut-off policies, procedures and practices.

6.2

Obtain an (aged, if available) accounts payable trial balance as of the historical balance sheet date. Determine whether the trial balance has been reconciled to the general ledger and gain an understanding of significant or unusual reconciling items.

Identify any significant past due balances and analyze in conjunction with non-operating liabilities.

6.3

Obtain a summary of the components of accrued liabilities and related supporting calculations as of the historical balance sheet dates.

Obtain an understanding of the nature of these accounts and the reasons for significant fluctuations in the account balances.

Inquire as to the existence of unrecorded or under (over) accrued liabilities and consider differences in year-end and interim accounting procedures on the accrued liabilities balance.

Comment on the likelihood of unrecorded or under-accrued liabilities or reserves.

7.

Debt

7.1

Inquire into the Company’s banking relationships including its outstanding indebtedness, borrowing terms and debt covenants, bonding requirements, and potential early repayment penalties.

8

Commitments and Contingencies

8.1

Obtain and analyze a summary of any asserted and un-asserted claims and assessments, including but not limited to litigation matters, indemnification obligations, and regulatory investigations.Obtain a schedule summarizing any beneficial or adverse litigation settlements during the historical period and determine impact on reported EBITDA.

8.2

Inquire as to the existence of any other significant commitments (such as leases, vendor contracts, purchase commitments, etc.) and contingencies and their impact on the proposed transaction. If applicable, obtain documentation to determine the potential future financial commitment of each.

8.3.

Obtain a listing of existing and future capital and operating lease commitments.

9.

Working Capital

9.1.

Prepare a working capital trend analysis for the historical periods. Identify and comment on variances and fluctuations.

10

Taxes: REVENUES AND EXPENSES

10.1

Obtain the details of the operating revenue and sampling the invoices.

10.2

Obtain the details of the operating cost and expenses and sampling the invoices.

10.3

Obtain the Value-added/Non-value-added Business Tax Form 401 and prepare the reconciliation statement for at least last two years.

10.4

Obtain the business income tax filing and approval letter for at least last two years.

DD-TW-040

What are general audit program of LDD (Legal Due Diligence) by Evershine?

Answer:

Each LDD Project will exist some specific audit area.

Basically after being engaged by clients, first job is to review if assigned LDD scope need special audit program.

Here we only list general LDD scope.

Legal and Compliance:

- Business Licenses:

Verify the company’s compliance with relevant business licenses - Pending Litigations:

Identify any ongoing or pending legal disputes. - Intellectual Property:

Ensure that patents, trademarks, and copyrights are registered and protected.

Contracts and Agreements:

- Major Contracts:

List and review major contracts, including suppliers, clients, and partnerships. - Employee Contracts:

Review employment contracts and labor compliance.

Taxation and Accounting:

- Tax Compliance:

Ensure the company complies with local tax regulations. - Accounting Practices:

Assess the company’s accounting practices and compliance with accounting standards.

DD-TW-050

What services can be provided of after-merger assistance by Evershine?

Answer:

After-merger assistance for better control through cloud collaboration IT system set up.

To help your merged Taiwan Company to be compliant with Taiwan local regulations.

Evershine will act as your compliance review role using our web-platform system to create a collaborative working environment, which allows you to perform financial control through parent company.

Evershine staff will review every transaction via the cloud system in our own office and see if these are compliant with regulations.

Evershine staff will go to your JV Company and provide consultation when necessary.

Since the staff of the Parent company can jointly review or approve every transaction through our Cloud System.

If your WFOE in Taiwan even is difficult to recruit qualified accountant, treasury, payroll handler and IT personnel , you can assign us temporarily.

Through our services, you will be very comfortable in controlling merged companies financially.

Contact us:

Email: tpe4ww.dd@evershinecpa.com

Or

Judy Wang Partner, CPA in Taiwan, MBA from Netherlands

Office Tel: +886-2-2717-0515 E100

Mobile: +886-972-235-766

Email: judywang@evershinecpa.com

Or

Evershine CPAs Firm//Evershine Patent Attorney Firm

6th Floor, 378, Chang Chun Rd., Taipei City, Taiwan R.O.C.

Dale Chen, Principal Partner CPA/Patent Attorney/MBA

Office Tel: +886-2-2717-0515 ext. 100

Email: dalechen@evershinecpa.com

linkedin address: Dale Chen Linkedin

Additional Information

Evershine has 100% affiliates in the following cities:

Headquarter, Taipei, Xiamen, Beijing, , Shanghai, Shenzhen, New York, San Francisco, Houston, Phoenix

Tokyo, Seoul, Hanoi, Ho Chi Minh, Bangkok,

Singapore, Kuala Lumpur, Manila, Dubai,

New Delhi, Mumbai, Dhaka, Jakarta,

Frankfurt, Paris, London, Amsterdam,

Milan, Barcelona, Bucharest,

Melbourne, Sydney, Toronto, Mexico

Other cities with existent clients:

Miami, Atlanta, Oklahoma, Michigan, Seattle, Delaware;

Berlin, Stuttgart; Prague; Czech Republic; Bangalore; Surabaya;

Kaohsiung, Hong Kong, Shenzhen, Donguan, Guangzhou, Qingyuan, Yongkang, Hangzhou, Suzhou, Kunshan, Nanjing, Chongqing, Xuchang, Qingdao, Tianjin.

Evershine Potential Serviceable City (2 months preparatory period):

Evershine CPAs Firm is an IAPA member firm headquartered in London, with 300 member offices worldwide and approximately 10,000 employees.

Evershine CPAs Firm is a LEA member headquartered in Chicago, USA, it has 600 member offices worldwide and employs approximately 28,000 people.

Besides, Evershine is Taiwan local Partner of ADP Streamline ®.

(version: 2024/07)

Please contact us through HQ4TPE@evershinecpa.com

More Cities and More Services please click Sitemap